Based on the recent fuel price review by the Department of Energy, South Africans should brace for an expected fuel hike.

Why you’ll pay more for fuel/gas

The expected fuel hike is due to expected global economic disruptions but specifically in South Africa and it’s developing countries.

There are two factors determine how much we pay for fuel.

(1) Global oil prices.

(2) The performance of the South African rand against major currencies such as the Dollar.

The economic factors that influence these two elements have not been favorable for a fuel price decrease.

1: The global oil price-volatility factor

On the first factor, oil prices have continued to be volatile in the Middle East, a major player in the global oil industry.

This, and other factors such as OPEC output restrictions and political changes in the Middle East, is likely to have a volatile, medium-to-long-term effect on the price of fuel.

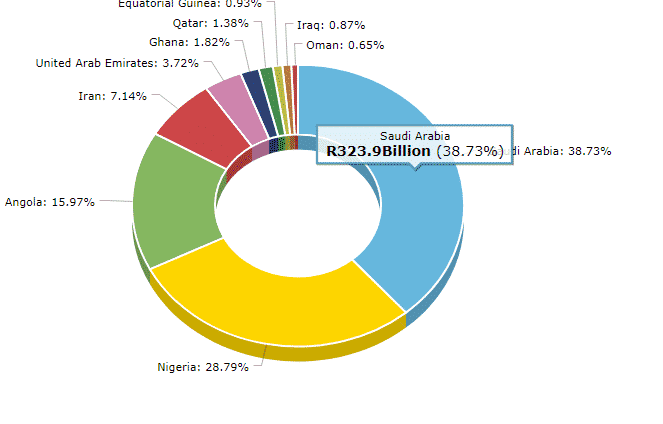

Given that Crude is one of the country’s main import and that Saudi Arabia accounts for more than 40% of South Africa’s oil imports—R323.9B.

Oil price volatility in major oil-producing countries such as Saudi Arabia, from where we import most of our crude, is never a good thing because it usually leads to higher crude prices.

This is a factor that increases production costs across major sectors of the economy.

Volatile global oil prices are ‘bad’ for the global economy and for our economy.

Especially because lower oil prices show a shrinking global economy.

Secondly, increased oil outputs against declining global demand have a negative effect on global economic growth.

2: The performance of the South African Rand against the Dollar

On the second influential factor, the rand has not shown a bullish performance against the dollar and other major currencies.

As predicted by the Automobile Association (AA), this downward trend is likely to continue.

Based on fuel price information released by the Central Energy Fund, AA predicts a 12 cents increase in petrol fuel prices in August.

Further increases are expected deep into the final quarter of the year given various unfavorable social-economic factors within and outside South Africa such as how the rand performs against the dollar.

How the Rand performs against the dollar largely depend on a number of factors but the most substantive at this point is investor outlook/sentiment.

According to Bianca Botes, Corporate Treasury Manager at Peregrine Treasury Solutions, investors consider the South African Rand a volatile emerging-market currency.

This and the Rand’s continued bearish performance against the dollar thanks to continued tension and volatility in the global economy translates into a poorer performance for the Rand.

This, in turn, has a negative echo effect on the overall economic outlook.

Given the overall volatility of the rand against the dollar, volatile oil prices, a declining economic outlook, and an unfavorable investor outlook.

South Africans should brace for tougher economic times and increased fuel prices due to the various socio-economic factors stated here.

Furthermore, some of South Africa’s greatest challenges such as high unemployment, high living cost, rising crime rates, and inequality also has a negative effect on the economy and the medium-to-long-term price of fuel in South Africa.